How To Get Rich (without getting lucky) - An Alternative Path

Mar 21, 2021

Disclaimer: this is not financial advice, do everything at your own risk. It’s what’s working for me.

Free spreadsheet: download

This post serves as an alternative path of How To Get Rich (without getting lucky).

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy.

— Naval (@naval) May 31, 2018

Trigger warning: this will be the opposite of what you have read about startups and wealth creation.

The Objective: get to FIRE number as quickly as possible.

What’s a FIRE number? FIRE stands for Financially-Independent-Retire-Early. It’s become more popular over the last few years. Google it.

The FIRE number is the total amount of net assets you need to never have to work again. Aka Fuck You money. For example if you have $1M in the stock market, your capital will compound at 7%-10% per year ($70k-$100K per year in appreciation) on average. So you withdraw 3%-4% of these assets every year ($30k-$40k / year) and let it work for you. So if you need $30k-$40k per year, your FIRE number is $1M.

To calculate your FIRE number (conservatively): take your estimated expenses per year x 33 To calculate your FIRE number (normal): take your estimated expenses per year x 25

The Step-By-Step Process:

- don’t be an indie hacker first

- work in a high paid contractor (ideally software engineer)

- cut your monthly expenses down to as close to zero as possible (move to a cheap country with high quality of life)

- invest every penny you can into the stock market through a LTD company

- when you hit your FIRE number stop working for others be an indie hacker again 😁

1. Don’t be an Indie Hacker first

What about startups? Why go “back to work”?

“Running a start-up is like chewing glass and staring into the abyss. After a while, you stop staring, but the glass chewing never ends”. -Elon Musk

Since 2015 I’ve started multiple startups and executed on most of Naval’s points. The issue is after a certain point your lack of material wealth starts to make you question what you are doing.

The truth is: 99.99% will fail, so you must try many ideas and have a very long runway of time to find a product that hits real-product-market-fit.

As such it’s much easier to think clearly and to persevere when you know you and your family are financially rock-solid forever. Aka fuck you money.

So in late 2020, I pivoted away from just startups. I went back into the consulting, working as a contractor for tech companies.

2. Work as a high paid contractor (ideally remote software engineer)

Why contractor? Why not a perm job?

Contract roles pay around double what salary jobs do. But if you take into taxes it’s more like 3x e.g. avg in UK is around $70K/yr for salary, but around $150K/yr for contract roles.

This is not exactly comparing apples with apples. Contract roles are volatile, no insurance, no support, higher risk. As such you get paid a lot more.

But TBH, if you’re a good engineer and great person to work with, you’ll never be out of work. The longest time I’ve had between contracts is a couple weeks. Who cares when you’re making good money.

3. Cut your monthly expenses down to as close to zero as possible (move to a cheap country with high quality of life)

The less you spend every month, the more you have to invest and the faster you hit your FIRE number. So if you live in an expensive place, MOVE. Move away to somewhere with a great quality of life and low living expenses.

I live in Italy, it’s wonderful in so many ways. Once Corona is over, we will travel around the world whilst we continue to save & invest.

Honestly this lesson took me about 10 years to learn. Cut your expenses! This is the biggest issue to fix first.

4. Invest every penny you can into the stock market through a LTD company

You get to invest nearly-100% of the income. Not 70% after taxes. This is huge.

How do you invest nearly-100% of the income? Your LTD company raises an invoice to a client for your time, charged on a daily basis. Once paid, pay yourself personally as little as possible to cover your living expenses and invest the rest into the stock market. More on the specifics of that later.

Which broker supports company accounts the best? Interactive Brokers, I’ve tried them all, Interactive Brokers are the cheapest and best.

The sign up process takes a while and is complicated as hell for LTD companies, but once done it’s your ticket to investing pre-tax cashflows and financial independence 🤑

What about corporation tax? Is that not a massive risk?

Yes absolutely. From beginning of financial year to when you have to pay the corp tax bill in most countries is around 18 months, 12 months trading, 6 months after end of financial year until you need to pay the corp tax bill.

If the worst case scenario happened and the market tanked, yes you would have to pay the corp tax bill with money you potentially don’t have. But the market would need to tank 100%. This is not possible, 50% is possible.

I’m comfortable with this risk because I can just use the cashflows from the current period to pay for the tax bill if this happened. This is highly unlikely.

If you are more risk-adverse

You can simply just invest the net income of your LTD company instead, keep the corp tax cash in the company bank account and sleep well.

The reason this strategy is so powerful is it reduces your income tax to hardly anything, because you pay yourself very very little, and invest the rest through your LTD company. Income tax is the highest cost for most people. This massively effects the power of compound interest over time. MASSIVELY.

I wish I had done this sooner

If I had understood this strategy in 2010 when I first started contracting and if I had just bought the S&P 500 (which I don’t recommend), I would have around $2M+ now.

4. When you hit your FIRE number, stop working for others and be an indie hacker again :-)

Ultimately everyday you wake up you should love what you are doing. Life is too short to spend time doing what you hate. So once you hit your FIRE number become an indie hacker again.

TBH, I’m playing with little ideas in the evening and weekends all the time. So you don’t need to stop completely, but once you hit your FIRE number you can go all in again.

I can bet, that what you work on when your are FI will be much different to what you work on right now. It will come from a place of strength and I can bet it will be inline with your values.

When you do build a product, make sure it’s a product people LOVE

What should you invest in?

Again, this is not financial advice, do everything at your own risk. But this is what I am doing.

I do not “trade” the market, don’t believe the bullshit you read online. The people that make the most is the people that buy, hold and never sell.

THINK IN DECADES.

It’s simple but hardly anyone does it. So that’s the first principle, buy, hold for min 10 years, do not sell.

I personally invest everything into $TSLA. This is because I understand the FSD opportunity and technology behind it, and that I know Tesla will achieve this and when they do the opportunity is in the 10s of trillions of dollars per year.

This is super high risk, Elon could die, the company could go bankrupt, I could lose everything. But I put a very low probability of this happening.

Upside I see on Tesla is around $40T+ market cap, it’s currently at around $600B, so around 50x from here, adjusted for dilution.

I’ve also started a $BTC position, I will probably scale this up to 10% of the portfolio. I personally think $BTC will be $1M per coin in around 5 years. 20x from here. And potentially $10M per coin in 15-20 years. So around 200x from here. $BTC is much higher risk that $TSLA.

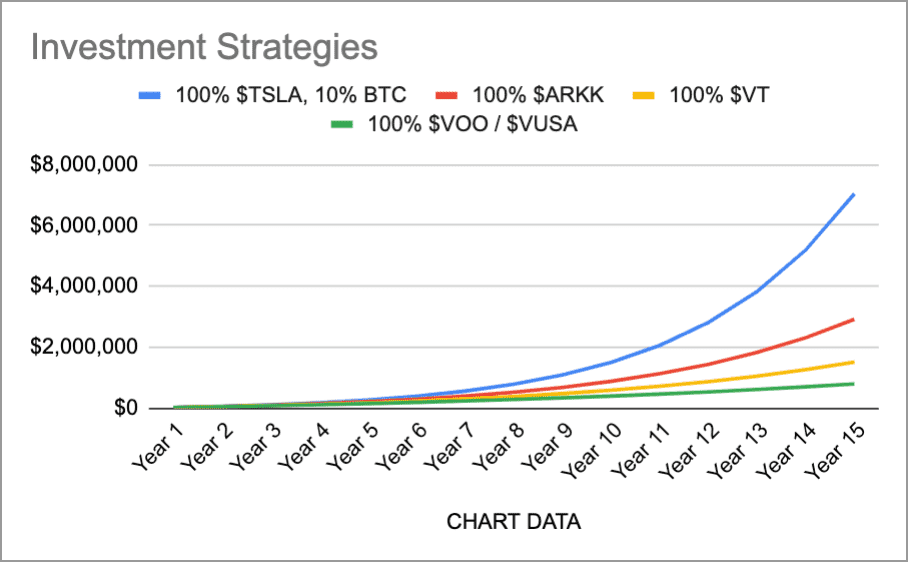

As of March 2021, this is how I would order potential invest strategies by expected annual return on your capital:

- 90% $TSLA, 10% $BTC - 40% CAGR for 15 years

- 100% $ARKK - 30% CAGR for 15 years

- 100% $VT - Vanguard Tech, done around 20% CAGR for last 10 years, expect 10-15% CAGR min

- 100% $VOO / $VUSA - S&P 500 - 7% CAGR forever

How does $2,000 invested per month perform with the above over a 15 year period? See below

Now in reality this will be choppy and volatile as hell. It’s not a line straight up, but if you look forward 15 years and look back it is. This is why you must think in decades, invest every month aka “dollar cost average”, hold and let the power of compounding do the work for you.

This is with $2,000 per month. With remote software contract roles this can be much much higher.

CLOSING

I wish you all the best, I hope you build a side project that makes you FIRE without having to go down this path but I hope you take note of what has been written here. This took me 10 years to learn. Ouch.